What started as a largely voluntary box-ticking exercise has shifted into a priority for investors globally, with ESG compliance coming under intense scrutiny as it represents a firm’s commitment to proper risk management and sustainable investing. However, maintaining a vigilant eye on compliance can be a complex undertaking, requiring a deep understanding of regulatory requirements and continuous monitoring of a firm’s operations.

What is ESG Compliance?

ESG compliance involves adhering to guidelines and regulations that govern environmental, social, and governance (ESG) standards as mandated by global regulatory bodies and frameworks. However, compliance is more than fulfilling a legal obligation — it’s also about taking proactive measures toward sustainability, and ensuring organizations have responsible and ethical business practices that can bring positive impact and change to the communities they operate in.

Ensuring ESG Compliance in Private Markets

1. Start Early and Set the Groundwork for Compliance

Being motivated to start is a great first step, but it’s critical to remember that ensuring ESG compliance takes more than just intention. Building disclosure reports involves materiality assessments, stakeholder buy-in, collecting data from your portfolio companies, and so much more — all processes that cannot be done overnight.

Start by identifying the compliance frameworks your organization needs to report to, before understanding the depth of their disclosure requirements. For example, the Task Force on Climate-related Financial Disclosures (TCFD) is especially pertinent to private markets, as it offers a structured framework for assessing and disclosing climate-related financial risks and opportunities of portfolio companies. You can then align those requirements with your goals, whether it be regulatory or an industry-specific objective.

Many organizations are also more prepared to comply than they realize. In 2023, the European Financial Reporting Advisory Group (EFRAG), the advisory body responsible for drafting the CSRD’s reporting standards, released a joint statement with the International Sustainability Standard Board (ISSB) and the Global Reporting Initiative (GRI) to confirm a high level of interoperability between their respective standards.

Not only does this significantly reduce redundancies and reporting burdens, but companies can also leverage these synergies to analyze gaps and develop robust governance processes to ensure they are better prepared to meet reporting requirements in the future.

2. Shift From Stakeholder Management to Stakeholder Engagement

ESG compliance isn’t just about numbers and data — it’s also a commitment to understanding and responding to the needs and concerns of stakeholders. Rather than viewing sustainability as a siloed responsibility, ESG leaders should be having active dialogues with internal and external stakeholders to understand their expectations and concerns around ESG, and how they can tailor their approach accordingly to drive further buy-in.

For instance, understanding investor expectations can lead to capital allocation to more responsible investments, while employee insights can encourage improvements in diversity, equity, and inclusion (DE&I) initiatives. These not only demonstrate a genuine commitment to ESG but can also bolster stakeholder relationships and further foster a culture of trust, transparency, and accountability.

Your stakeholders are the stewards of your company’s values, and implementing a collaborative, inclusive approach to stakeholder engagement can truly transform how ESG is integrated and perceived across the organization.

3. Empower Your Portfolio Companies

Obtaining high-quality, accurate ESG data from portfolio companies has both been a priority and a challenge for GPs, with 71% citing “incomplete and inconsistent” data as a barrier to ESG investing. Given how quality data is inextricably linked to compliance, firms need to engage and empower their portfolio companies in order to get the data they need to reliably track ESG performance and progress.

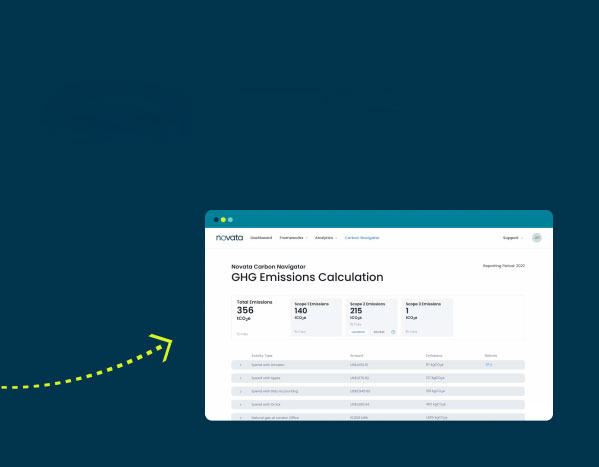

Establish the challenges faced by your portfolio companies, such as a lack of ESG maturity or limited resources, and provide them with the necessary tools, training, and resources to overcome these gaps. This might include anything from training sessions to adopting an end-to-end ESG data collection platform to simplify metric selection and data analysis. The goal here isn’t to further burden your portfolio companies but rather to support them in their reporting efforts without disrupting their day-to-day operations.

4. Don’t Be Afraid To Lean on Peers and Seek Support

Ensuring ESG compliance can be an arduous journey alone. If you’re facing major roadblocks, be empowered to lean on industry peers and seek support from industry associations, advisory bodies, or even external ESG experts.

Collaborating on best practices, participating in ESG forums, and sharing resources can be mutually beneficial. Not only will you gain insights and tips from others’ successes and learnings, but it also contributes to industry-wide advances in ESG reporting and compliance. Such collective knowledge can be invaluable in shaping your firm’s compliance strategy and ensuring that you’re at the forefront of meaningful ESG action.

5. Adopt a Compliance Checklist

Having an ESG compliance checklist can put your current ESG practices and performance into perspective while acting as a guideline to maximize compliance efforts. What goes into your checklist should ideally align with your specific organizational goals, but below are a few essential steps that should be included:

- Alignment with regulatory frameworks that your firm needs to adhere to

- ESG performance assessment against set targets to track progress

- A review of ESG risk management strategies based on regulatory changes, operational feedback, and other emerging trends

- A standardized approach to data collection

- Discussions with stakeholders to obtain feedback and suggestions on key ESG issues

- Seeking third-party verification to deliver reasonable assurance of your ESG performance and data

The Road to Compliance Is Not Easy, but It Needs To Be Done

ESG compliance often comes naturally as a byproduct of a firm’s high governance standards and genuine commitment to sustainability. Ensuring compliance takes plenty of time and preparation, especially for firms disclosing for the very first time.

Many firms struggle with the collection of accurate, reliable ESG data, which are the building blocks for ESG compliance. Novata helps streamline the data collection process and makes it easy to gain actionable insights from the data. Learn more about how Novata can help.