The Science Based Targets Initiative (SBTi) has quickly become a trending topic in corporate sustainability amid rising demand for companies to disclose emissions and reduction plans. The SBTi was created to provide clear guidance for companies to decarbonize their operations by reducing their carbon footprint and reaching net zero emissions, aligned with the Paris Agreement. This article explores the SBTi and why setting science-based targets is important for companies to prioritize emissions reduction and reach sustainability goals.

Why Companies Adopt Science-Based Targets

In 2023, approximately 4,204 companies set and received validation for their science-based targets from SBTi, twice the number from 2022. Companies, including financial institutions, are increasingly adopting science-based targets for a variety of reasons.

For one, governments and regulatory bodies are progressively setting stringent climate regulations. One such example is the European Union’s (EU) Corporate Social Responsibility Directive (CSRD), which mandates companies to report on environmental, social, and governance (ESG) metrics with detailed sustainability data and disclose their strategy and progress toward climate goals. Non-compliance with this regulation could lead to significant penalties, including fines, legal action, and restrictions on operations in the EU. Setting ambitious emissions reduction targets aligned with climate science helps companies stay ahead of the regulatory requirements.

Additionally, stakeholders, including investors and consumers, are demanding transparency and accountability on corporate climate action. Adopting science-based targets has been shown to enhance reputation and stakeholder trust. Apart from these primary reasons, science-based targets can also help companies streamline their decarbonization efforts, leading to innovation and reduced environmental risks. Setting science-based targets can be the first step toward building a more resilient organization, ensuring a better future while strengthening operations.

The Science Based Targets Initiative and the Financial Sector

Companies across the globe, industries, and sectors have aligned their carbon footprint reduction efforts with the SBTi in their climate strategy. Currently, SBTi claims to have 8701 companies from sectors such as manufacturing, food and beverage, retail, finance, and energy committing to targets, and 4384 with approved and active targets as of May 31. Among the 53 sectors, the diverse financial sector, accounting for 222 entities and representing 5.1% of all target setters globally, ranks as the sixth highest in SBTi target adoption. Sector-specific companies have seen the highest adoption, while SMEs are increasingly participating due to a streamlined target-setting process tailored to their scope and resources.

Setting science-based targets can be challenging for large enterprises and financial sector participants due to the scale and complexity of their operations. These challenges often are a result of multidisciplinary operations, complex and widespread operations, higher resource intensity, and potential lack of buy-in from several stakeholders. Despite these challenges, financial institutions have been steadily and increasingly committing to setting emissions reduction targets. General Partners in the private markets, in particular, are now requiring their portfolio companies to set these targets to enable firms to determine reduction goals for the emissions they finance.

A Checklist for Setting SBTi-Aligned Targets

The SBTi provides customized guidance for target setting based on factors such as industry type, company size and type, and ability to set targets. For companies getting started with the process, here is a checklist to keep in mind:

- Get familiar yourself with the SBTi sector-specific guidance relevant to the company. SBTi provides tailored guidance on data collection quality, material topics, and more to help companies understand what is required.

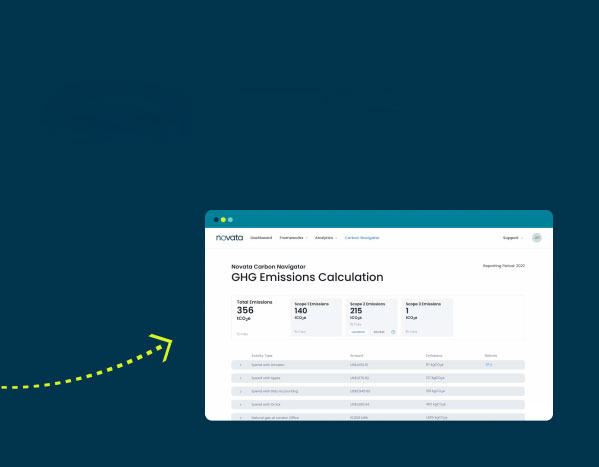

- Build a greenhouse gas (GHG) inventory. Calculate your Scopes 1 (direct), 2 (indirect), and 3 (value chain) greenhouse gas emissions using the Greenhouse Gas Protocol. This can be a challenging undertaking but is imperative in the process of decarbonization. A greenhouse gas inventory will enable companies to create a baseline of your emissions to guide your target-setting and reduction plans.

- Review available data and assess its quality. Based on the information gathered, companies should ascertain scopes and boundaries. For instance, determine if the company will set targets based on company level or subsidiary level given what is feasible for the organization and what’s needed for implementation.

- Set preliminary goals. Based on the data, strategy, and implementation feasibility, set long-term and near-term goals aligned with the SBTi.

- Near-Term Targets: These targets are set to be achieved within five to ten years. For Scope 1 and 2, targets should cover at least 95% of emissions. For Scope 3, if the emissions are significant (over 40% of total), the target reduction plan should cover at least 67% of the emissions.

- Long-Term Targets: These targets are set to be achieved by 2050 or sooner. For Scopes 1 and 2, targets should aim for a 95% reduction, while Scope 3 targets should cover a 95% absolute reduction plan.

- Gather supporting documentation. Review GHG Inventory reports with attention to detail and collect all other supporting documentation.

- Engage stakeholders. Ensure internal stakeholders, such as employees and C-suite members, are aligned with the strategy and targets. Communicate goals and requirements with stakeholders transparently to keep everyone on the same page.

- Submit targets for validation. A team of experts at SBTi reviews submissions to verify alignment and adherence to guidance. They conduct thorough checks of the quality of the data and its robustness before validating the targets.

SBTi and Carbon Offsets

In 2023, SBTi released guidance for the financial sector, which faced significant backlash for its stringent requirements to cease fossil fuel financing, complex and difficult-to-implement guidelines, and ambitious 1.5°C target alignment to limit global temperature rise. Critics called for a more gradual transition and stricter anti-greenwashing measures. The revised SBTi Financial Institutions Criteria Version 2.0 simplifies the transition from fossil fuels, offering clear guidelines and specific criteria for fossil fuel financing. This aims to allow financial institutions to align their operations and strategies to transition to financing a low-carbon economy.

Recently, the SBTi’s board announced a policy change aimed at allowing carbon offsets for the reduction of Scope 3 emissions. This decision was intended to provide more flexibility for companies to meet their climate goals. However, it was met with criticism from internal and external stakeholders for undermining the scientific rigor and credibility of the initiative. In response to the backlash, the SBTi Board of Trustees clarified that no changes had been made to its existing standards and any future modifications would follow an evidence-based process. It emphasized that environmental attribute certificates for Scope 3 emissions would be based on scientific evidence and announced plans to release a draft proposal for changes to Scope 3 target setting in July 2024 for further stakeholder engagement.

While the industry awaits future updates, companies should continue to pursue readiness to align with the SBTi, given that it is interwoven into regulations and remains a hot topic for requests from investors.

Setting Science-Based Targets with Novata

The SBTi remains one of the most revered and globally recognised frameworks for setting emissions reduction targets and aligning with its requirements starts with having accurate data. Novata supports firms and private companies in calculating emissions data and capturing a GHG inventory based on the GHG Protocol. Our target-setting tool, based on the SBTi guidance, also allows customized target setting, using the baseline data captured through our Carbon Navigator. Learn more about Novata’s flexible carbon solutions for the private markets.