Demand for ESG adoption in private equity has gained significant traction, in part due to limited partners’ (LPs) growing preference for ESG-conscious investments. As LPs continue to focus on ESG, the big question is — are general partners (GPs) delivering on what is expected of them?

To address these concerns and provide further context on how the LP-GP relationship is the cornerstone for ESG success, Novata recently held a webinar exploring LP expectations on GP’s sustainability strategies.

The session was moderated by Lorraine Wilson, Chief Sustainability Officer at Novata, and featured a roundtable discussion with panelists in the private market sector. Speakers included Nina Krauss, Director of Sustainability at Hamilton Lane; Paul Fahey, Head of Investment Data Science, Asset Servicing at Northern Trust; and Matt Schey, Managing Director of External Affairs and Sustainable Investing at the Institutional Limited Partners Association (ILPA).

Below are five key takeaways from their conversation on how LP expectations are evolving, and best practices to ensure alignment between GPs and LPs.

1. Communicate With LPs To Determine Material Metrics

Determining what ESG metrics are material is a critical part of an ESG strategy. According to Bain & Company, nearly half of the LPs in a recent survey expressed they want GPs to provide relevant or material ESG-related KPIs; yet GPs face hurdles in providing the data to demonstrate the effectiveness of their ESG efforts.

Despite the availability of resources like the Sustainability Accounting Standards Board (SASB) and the Principles for Responsible Investment (PRI) to support the identification of material risk factors, a lack of industry-wide standardization continues to exist. Hamilton Lane’s Nina called out the need to align relevant metrics both at the asset and portfolio level to ensure meaningful reporting, an effort that opens significant room for collaboration with GPs. Establishing a common language and understanding of why certain data is pertinent or not drives more strategic decision-making to enable mutual success.

2. Focus on Data Progress, Not Perfection

The pressure to collect as much ESG data as possible has led to the misconception that the data needs to look good on paper the first time it is reported. Panelists noted that LPs are aware that the state of today’s data ecosystem is a work in progress; hence, rather than an emphasis on perfection, LPs are utilizing the trends within the data to forecast and enhance future performance. The goal is to track improvements over time, put processes in place to manage material considerations, and relate that progress to what investors are trying to achieve.

3. Stay on Top of Regulatory Shifts

Change is a constant when it comes to the ESG regulatory landscape, and GPs need to be proactive in their efforts to stay informed and compliant. ILPA’s Matt shared that GPs cannot afford to only monitor regulations of the purviews they fall under; keeping a pulse on what’s happening globally ensures a GP’s portfolio is resilient against shifts in investor sentiment and global policy trends. Adopting this forward-looking approach also allows GPs to anticipate future disclosure asks from LPs and be better positioned to meet those requirements.

On that note, Nina points out that investors may seek or request bespoke disclosure requests from GPs to enhance disclosure, set alignment, or shift a portfolio tilt. These commitments require a significant amount of preparation to get right, so starting early is crucial.

4. Tie ESG Strategies to Value Creation

For LPs, effective ESG reporting goes beyond the numbers; it’s about articulating why the data matters and transforming it into actionable value creation. “GPs who can link their ESG initiatives directly to value creation strategies, show how they identify material considerations and how these considerations create more resilient and profitable businesses are the ones who stand out,” Matt said.

Transparency further characterizes what good reporting looks like in the eyes of LPs. Our panelists observed that some GPs may grapple with effectively communicating the why behind their strategies or processes with portfolio companies. Having open dialogues with LPs about their broader sustainability goals not only drives crucial conversations about identifying areas of improvement, it maximizes due diligence efforts and determines action steps to capitalize on opportunities more effectively.

5. Learn How LPs Are Leveraging the Data

Validating value creation is a critical part of how LPs are leveraging the data, be it to inform more tactical investment decision-making or to enhance their ongoing ESG initiatives. LPs can utilize this data in a few ways:

- Fundraising: GPs on the fundraising trail should note that overlooking ESG will have them leaving value on the table. Nearly 50% of LPs stated that the lack of ESG integration through the deal cycle impacts manager selection. In addition to encouraging GPs to understand how LPs interpret and integrate this data into processes, panelists suggested asking questions to facilitate smoother communication.

- Benchmarking: LPs are able to monitor the effectiveness of sustainability strategies over time, benchmark performance against peers, and use that data to move toward best practices.

- Driving a strong ESG narrative: LPs have access to compelling, data-driven insights that can not only improve exit valuations of a portfolio company but also enable LPs to position themselves as leaders in sustainability.

Aligning Expectations For ESG Success

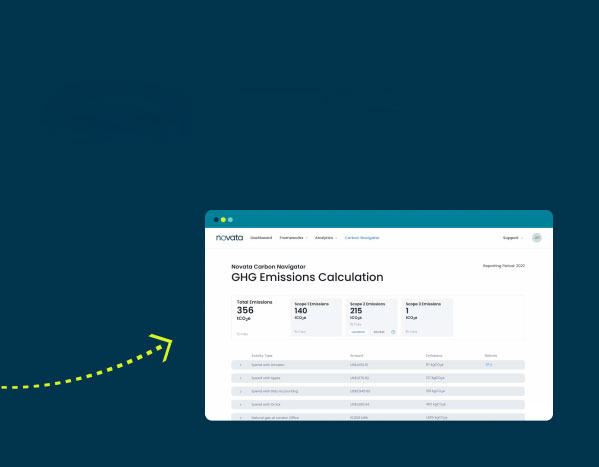

Bridging the GP-LP divide begins with aligning expectations across the board. Finding the right balance between meeting LP demands and effective resource management can be tricky, especially against the backdrop of changing regulatory requirements and mounting market pressures. Novata provides a dedicated sustainability software solution and in-house ESG expertise to help firms develop an ESG strategy or identify ways to guide portfolio companies to share quality data. Partnering with Novata empowers GPs to confidently deliver on what is expected of them, regardless of where they are in their ESG journey.

Watch the webinar replay for more insights on LP expectations for GPs on ESG and reach out to learn how Novata can help optimize your ESG journey.