Novata sat down with Henry Philipson, President of ESG_VC, to delve into their innovative framework that’s reshaping how venture capital firms support their portfolio companies on ESG initiatives. Throughout the discussion, Henry shares the origins, goals, and strategic implementations of the ESG_VC framework, as well as the significant impact it aims to have within a venture capital ecosystem that is seeking to support sustainable and inclusive growth across global markets.

Q: Novata recently announced a partnership with ESG_VC. Could you explain what ESG_VC is?

Henry Philipson: ESG_VC is a network of venture capital firms from regions including the UK, Europe, North America, and Australia. We focus on helping our portfolio companies measure and improve their ESG performance. Initially, it was just a small group of us, but it has quickly evolved into a community of more than 250 venture capital firms working with hundreds of companies to get to grips with ESG.

The framework caters specifically to startups. Startups are unique because they are smaller and have fewer resources, making it crucial for tools and frameworks to be tailored to their specific needs. Whereas other ESG frameworks are designed for larger companies or different stages of private equity, the ESG_VC Measurement Framework understands the unique characteristics of the venture industry and provides it with a pragmatic approach for measuring ESG.

Q: Can you elaborate on the unique opportunities startups have with ESG integration?

Henry: Startups have the advantage of integrating ESG factors into their operations and strategy at the beginning of their journey. Our framework is designed to be educational and straightforward, providing startups with clear guidance on how to embed sustainability, diversity, inclusion, and governance as they grow.

We also find that startups are increasingly recognising the commercial benefits of embracing ESG. People want to work for companies with a purpose, customers want to buy from brands with a mission, and investors want to back startups that can scale efficiently and responsibly. Leveraging these trends can unlock significant growth for startups.

Q: In what ways does the ESG_VC framework accommodate different geographical needs?

Henry: ESG within venture capital has grown significantly in recent years, especially in the UK and Europe. Our members, mainly from these regions, have been pioneers in adapting ESG principles to venture capital, creating a robust infrastructure for early-stage companies and their investors to engage with ESG.

Our framework was initially designed with a European focus but has been adapted by members in other regions like the US, Canada, Australia, and New Zealand. We strive to tailor the framework to accommodate the diverse regulatory and cultural contexts of our global membership base.

Q: How does ESG_VC’s framework promote interoperability and reduce fragmentation in the ESG landscape?

Henry: We aim to align our framework with other industry standards and frameworks for efficiency, especially for reporting and compliance. Although the ESG_VC framework is specific to the venture capital sector, we maintain close relationships with other standard setters to ensure compatibility and coherence.

Q: What feedback have you received about the ESG_VC framework from investors and entrepreneurs?

Henry: The feedback has been largely positive, with companies appreciating how the framework helps them build a comprehensive understanding of ESG practices without having to invest huge sums of time or money. For example, we’ve heard of several companies successfully using our framework for their annual ESG benchmarking and performance tracking, which has been crucial for their growth and sustainability efforts.

Q: Lastly, what are the key benefits for entrepreneurs in tracking ESG metrics through your framework?

Henry: Tracking ESG metrics allows entrepreneurs to identify and focus on areas critical to their business growth and operational efficiency. Our framework helps companies identify what’s materially important to them, enabling them to manage risks better and seize value creation opportunities effectively.

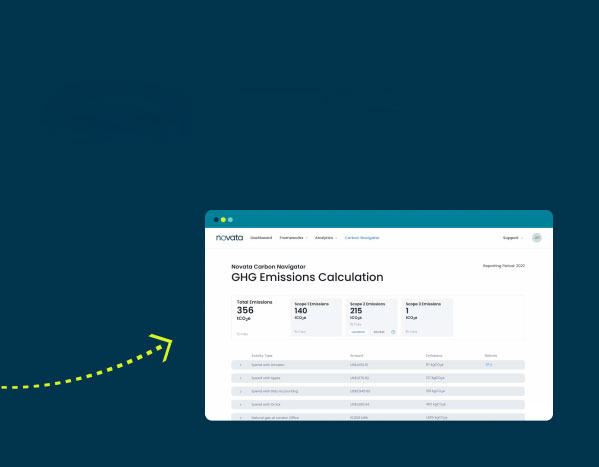

Novata is the primary partner of ESG_VC Measurement Framework, which will be available on Novata’s platform. Talk to an expert to learn more about the framework.