On November 28th, 2023, the Financial Conduct Authority (FCA) published the final guidance on its framework for Sustainable Investment Product Labels and Anti-Greenwashing Rule in the UK. The framework was constructed to tackle greenwashing in the UK financial market by increasing transparency, fostering a fair market, protecting institutional investor interests regarding sustainability claims while ensuring that such claims are fair, clear, and not misleading, and establishing accurate and well-defined naming and marketing standards for investment.

The Anti-Greenwashing Rule is the first to come into force on May 31st, 2024, making it the most pressing deadline for compliance. The rule applies to all FCA-authorized firms that make sustainability-related claims about products and services, including all UK authorised firms, such as all asset managers, debt firms, and banks, regardless of whether or not they are covered by other aspects of UK Sustainability Disclosure Requirements (SDR) and the client categorization of UK investors. There has already been much pushback from firms stating that they need more time to prepare for the regulation; however, this is set to go ahead as planned.

While the framework only applies in the UK currently, the FCA intends to expand the scope outside the country and consult with other international frameworks, including the Task Force on Climate-Related Financial Disclosures (TCFD), for alignment. Firms should be aware and stay ahead for potential expansion.

Anti-Greenwashing Rule

The new rule under ESG4.3.1R mandates that all FCA-regulated firms ensure that any sustainability-related claims about financial products or services are clear, fair, and not misleading. The FCA’s guidance consultation GC23/3 provides firms with the necessary tools to implement this rule effectively. The guidance suggests that sustainability claims must be correct and capable of being substantiated, clear and easily understood, complete without omitting significant information, and fair, especially when making comparisons to other products or services. It is highly recommended that FCA-authorised firms thoroughly review this guidance to understand how to apply the rule in various scenarios.

The Anti-Greenwashing Rule requires that sustainability claims must adhere to specific FCA standards. These standards require such claims to be transparent, equitable, and free from misleading information. For example, any reference to a product’s sustainability characteristics must be proportional to its actual attributes. This means that disclosures, especially for asset managers incorporating sustainability-related policies, should accurately depict the sustainability aspects of their investment strategies without exaggeration. By following these guidelines, firms can ensure that their sustainability claims are accurate and evidence-based, aligning with the FCA’s aim to maintain integrity in sustainability representations.

In April 2024, the FCA released the Final Guidance for the Anti-Greenwashing Rule, which provided further clarity on the Rule’s expectations. In summary, the guidance proposes that sustainability claims should be:

- Correct and capable of being substantiated

Firms must ensure that all claims made about their products or services are factually accurate and not overstated or exaggerated, particularly regarding sustainability or positive social and environmental impacts. These claims should accurately reflect the characteristics of the product or service. Additionally, products and services should deliver on the promises made, with firms able to provide robust evidence to support these claims at the time they are made.

Sustainability claims must be substantiated with sufficient evidence, and firms are expected to conduct thorough reviews of all documentation, including websites, PPMs, and marketing materials, to ensure compliance with anti-greenwashing regulations. For instance, if a firm asserts ESG screening for investments, it must demonstrate that this process meets regulatory standards.

- Clear and presented in a way that can be understood

It is essential to be absolutely clear in presenting sustainability-related claims to ensure they are easily understandable for stakeholders. Straightforward language should be used, avoiding technical jargon unless necessary. Broad terms or vague statements should also be avoided to prevent confusion or misinterpretation. It’s also crucial for firms to assess the relevance of information provided to different audiences, tailoring communication appropriately for professional versus retail clients. Overall, clarity and transparency are essential to effectively communicate sustainability initiatives and commitments.

- Complete – they should not omit or hide important information and should consider the full lifecycle of the product or service.

Firms must ensure they do not omit any crucial information from their materials concerning sustainability-related claims, as this information could influence the decision-making processes of investors or other stakeholders. Full disclosure is key to maintaining trust and credibility. Claims should provide a representative picture of the product or service, without omitting or hiding important information that might affect decision-making. If claims are true only under certain conditions, these conditions should be clearly and prominently stated, along with any limitations of the information, data, or metrics used.

Firms should present a balanced view, considering both positive and negative aspects. Additionally, the entire lifecycle of a product or service should be considered when making sustainability-related claims. Claims should be based on the full life cycle, or if only certain elements are relevant, firms should specify which part of the lifecycle the claim pertains to, avoiding cherry-picking information that may mislead stakeholders about the product’s or service’s true sustainability characteristics.

- Fair and meaningful in relation to any comparisons to other products or services

When firms compare their products or services to previous versions or competitors, fairness and meaningfulness are paramount. These comparisons should empower consumers to make informed decisions. Sustainability claims must clarify what’s being compared and how, ensuring apples-to-apples comparisons. Market-wide comparisons based on limited samples risk misleading audiences.Additionally, caution is advised when asserting sustainability characteristics for a product or service that merely meets minimum legal standards, as this could misleadingly imply that it is superior to other available options. Any evidence supporting comparative claims should encompass all products or services involved.

Preparing for the SDR’s Anti-Greenwashing Rule

As the Anti-Greenwashing Rule comes into effect, steps firms can take to prepare include:

- Review all communications, including to investors and external, as appropriate to ensure compliance with the anti-greenwashing rule and guidance.

- Ensure that existing measures, including accurate data to substantiate claims, are well managed.

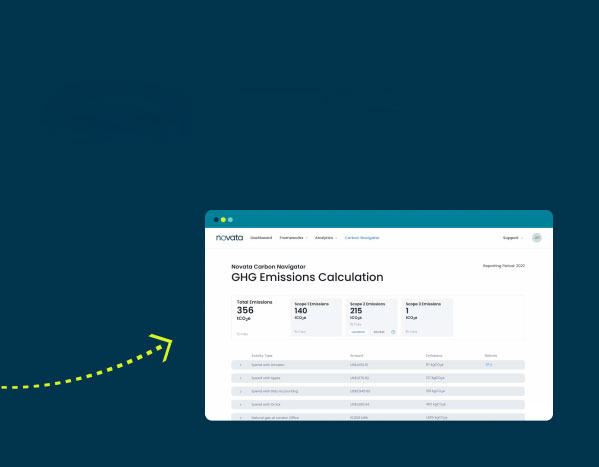

Learn more about how Novata can help you simplify ESG data management to track KPIs and streamline your sustainability journey.