The Corporate Sustainability Reporting Directive (CSRD) is a legislative framework adopted by the European Union (EU) to enhance sustainability reporting and increase transparency on social and environmental issues within corporations. Although the European Commission proposed the directive as part of the EU’s broader efforts to achieve the objectives set out in the European Green Deal, it is far-reaching in its scope and impact, affecting a wide range of companies, markets, and stakeholders across the EU and beyond.

Global Reach for Global Impact

Over 60,000 EU and non-EU companies will reportedly fall within the scope of the CSRD from 2024 to 2029. While it’s often discussed under the umbrella of “European regulations,” the CSRD is meant to drive global impact, and that means companies across markets will be required to prepare reports in line with the directive. Thousands of companies in virtually all markets will be required to disclose their impacts to people and the planet in accordance with the European Sustainability Reporting Standards (ESRS) during timed phases that align with business characteristics. That means companies across the world, including in the UK, US and APAC, need to be prepared to report in line with the appropriate phase and timeline for their business.

As the table below shows, some companies are already impacted, and by 2029, any company with significant activity in the EU, regardless of their location, will be required to report.

CSRD’s Reach Across Companies and Markets

| COMPANY CATEGORY | FIRST REPORT DUE | FIRST YEAR OF DATA TO BE REPORTED | COMPANY CHARACTERISTICS | MARKETS IMPACTED |

|---|---|---|---|---|

| Public-Interest Entities | 2025 | 2024 | Meets both of the following:

|

EU |

| EU-Listed Large Companies and Parent Companies | 2026 | 2025 | Meets 2 of the following:

|

ALL

Non-EU companies with listed securities on an EU-regulated market and parents of large EU groups will fall into this category |

| EU-Listed SMEs | 2027 | 2026 | Meets 2 of the following:

|

ALL

These companies will use the SME-specific standards and have a two-year “opt-out” period available to them |

| Non-EU Companies With Significant EU Activity | 2029 | 2028 | Meets 1 of the following:

|

ALL

These companies will use Non-EU specific standards, which are slated to be adopted in 2026 |

CSRD’s Reach Across Stakeholders and Operations

- Identification and Participation of Broad Stakeholder Groups: To identify the impact on workers, consumers, and surrounding communities, companies must undertake a Double Materiality Assessment to become compliant with the CSRD. This is about identifying what matters to the company and its value chain through two lenses: environmental or social impact and financial.

- Impact on Corporate Governance: The CSRD requires companies to integrate sustainability considerations into their business strategies and governance structures. This includes board oversight and management accountability for sustainability issues. For some, this may include needing to source additional funds and resources to integrate the relevant knowledge and governance into the company.

- Influence on Global Supply Chains: Companies subject to the CSRD will need to report on their value chains. Some examples may include gaining information from suppliers, which (although sometimes challenging) may encourage better sustainability practices and transparency throughout global supply chains. With many companies’ supply chains disproportionately located in APAC, the need to understand the impact of this regulation has never been more important.

- Investor and Stakeholder Engagement: By providing standardized and reliable sustainability information, the CSRD empowers investors and stakeholders to make informed decisions regarding their investments and relationships with companies. Although subject to materiality, much of the information provided will also be useful for investors’ own Sustainable Finance Disclosure Regulation (SFDR) compliance needs.

- Harmonization with Global Standards: The CSRD aligns with other international sustainability frameworks and standards, such as the International Financial Reporting Standards (IFRS) and the Global Reporting Initiative (GRI). It is hoped that this will promote further standardization and consistency in sustainability reporting worldwide, therefore impacting not only the companies subject to reporting, but the frameworks they are aligning to.

In summary, the CSRD has a substantial reach, affecting a wide array of companies, stakeholders, and markets. Its influence extends beyond the EU with companies worldwide needing to adapt to its requirements to maintain competitiveness and market access in addition to supporting their stakeholders’ disclosures and compliance needs.

Not sure if you’re in scope?

- Take our free assessment to receive:

– A timeline for when your company will be subject to CSRD reporting

– Industry-specific insights and double materiality prep

– A preliminary roadmap to get started with CSRD

- Talk to your legal and compliance teams.

While we can give you a steer, it’s critical that you engage your company’s legal and compliance advisors immediately in order to be certain of your full obligations.

- Start to get familiar with the regulation.

See our CSRD Guide for more information about what the regulation is and what you need to do to get ready.

- Get in touch.

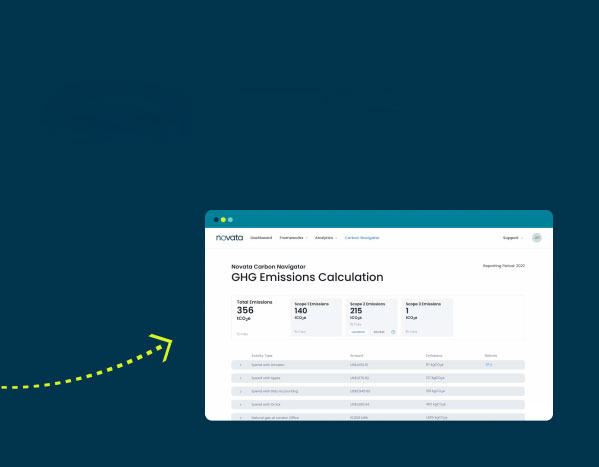

Find out how our suite of expert services, paired with our leading ESG data management platform, can help to remove the operational burdens and uncertainties associated with the CSRD and position you for success.