Cheyne Capital is a leading alternative investment fund manager based in London. The firm invests across the capital structure, focusing primarily on corporate and real estate assets. Novata sat down with Cheyne Strategic Value Credit’s Managing Director and ESG Lead, Audra Walton, to explore the firm’s commitment to sustainability, the challenges they have faced with data collection, and the benefits they anticipate from implementing a software platform.

Our Conversation with Audra Walton

What is your role at Cheyne Capital, and what do your responsibilities entail?

I am a Managing Director and the ESG lead at Cheyne Strategic Value Credit, a division of Cheyne Capital, which is an alternative investment fund manager headquartered in London. I am responsible for ESG throughout the deal lifecycle across all our funds. This includes ensuring that ESG considerations are integrated into every investment decision, thorough ESG due diligence is executed on each transaction, and that we’re supporting our portfolio companies on their ESG value-creation journey.

What sparked your interest in the ESG/sustainability space?

Many people have an ‘ah-ha’ moment when their interest in something becomes clear. From a young age, I have been equally interested in finance, business, and sustainability, and in my early career I really struggled to choose. Luckily for me, these topics have converged over the past 15 years, so in the end, I didn’t have to make a choice. My core interest in sustainability, however, has been there since childhood.

What challenges were you facing in managing ESG within your firm before finding a software solution?

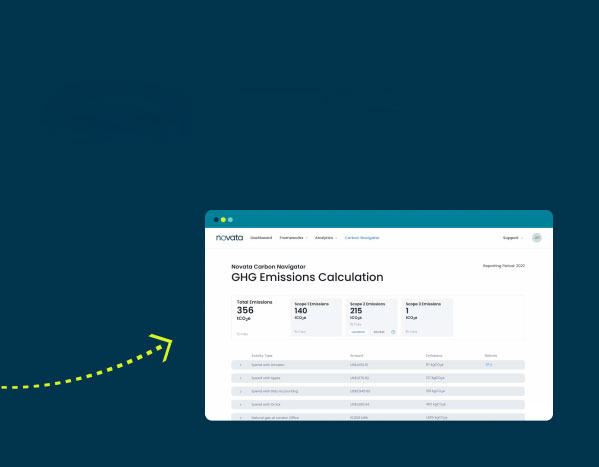

Before we implemented Novata, we had a couple of big challenges. The first was integrating the leading ESG data frameworks into one questionnaire for our portfolio companies. With Novata, we could compare frameworks against each other, allowing us to create a streamlined set of questions without duplicated data points that covered the key frameworks—for example, the EDCI and the SFDR PAIs. The second challenge we had was integrating the bespoke metrics we have for our funds and our Article 8 framework. With Novata, custom questions were built into the questionnaire, centralizing all our data and allowing us to report holistically.

How did you go about researching and evaluating potential software solutions for ESG management, and what factors were most important to your decision-making process?

I did quite a lot of research and made a shortlist of three providers before getting demos. Usability, scalability, benchmarking, EDCI integration, price, and support were some of the key considerations in our decision. Also, the Novata team was very responsive and great to work with.

What benefits are you hoping to see after implementing software?

The key benefit we are hoping to see this year once we have all our data in Novata is effortless reporting. We have a variety of reporting requirements that have historically been time-consuming to meet. Now that we have Novata in place, reporting can be done with far less time and effort. Additionally, by using the dashboard, we are able to look at aggregated data points across portfolios and compare funds to one another.

What advice would you give to others in your industry who are just starting to incorporate ESG factors into their firm’s strategy?

You can’t know what “good” looks like unless you are measuring, tracking, and comparing. The key thing is knowing why you are collecting each data point. Every question should have a purpose, whether it is a regulatory requirement, a KPI for an ESG margin ratchet, or simply to track progress on the topics your firm cares about. And while it can be painfully difficult to get data sometimes, you have to start somewhere.