Bonaccord Snapshot

- Bonaccord Capital Partners is a $3.6 billion middle-market GP stakes firm and a value-added partner to sponsors at an inflection point for their next stage of growth.

- The firm views ESG factors as critical to risk management. To optimize its ESG approach, the team needed the ability to provide input to GPs as well as a solution to measure quantitative data and track progress year-over-year.

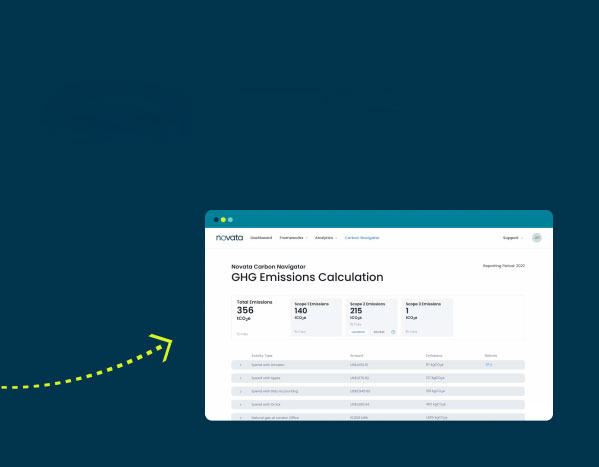

- Bonaccord leveraged Novata’s platform and in-house expertise to develop a framework of comparable, standards-aligned metrics and collect data seamlessly across the portfolio, leading to a 100% response rate to its ESG survey.

Not a lot of firms do what Bonaccord Capital Partners does: the $3.6 billion middle-market GP stakes firm provides growth capital to middle-market private market sponsors across private equity, private credit, private real estate, and real assets. Bonaccord’s differentiator is the firm’s commitment to being a “value-added partner” to sponsors at an inflection point for their next stage of growth, in capital formation, launching ancillary strategies or different product lines, and succession planning.

For Bonaccord, that value creation lens extends to its ESG efforts. The firm is committed to integrating ESG factors into its internal management, investment decision-making, and portfolio oversight. In a sector where these considerations are becoming increasingly relevant, Bonaccord has advanced its ESG strategy by leveraging Novata’s platform to enhance data collection and management processes.

Bonaccord’s Stance on ESG Integration

It’s no secret that there’s a heightened focus on ESG data globally, and Bonaccord’s LPs and partner sponsors understand that. As a result, building out Bonaccord’s ESG program became a main priority for Wylie Fernyhough, Vice President, and Sophia Kolodzinski, Associate. While there was already a focus on ESG efforts at the firm, it wasn’t tailored to fit the needs of both the Bonaccord management company and the partner sponsors across the portfolio. The firm needed to not only have a strong program in place, but also the ability to provide input to GPs about building their ESG programs.

Bonaccord’s investment team examines risk as a critical part of the investment process and aims to understand how the GPs they’re considering investing in compare to those in their portfolio, based on the data they collect in their annual survey and broader market knowledge. The firm views ESG factors as crucial to the risk screening process. “An investment could look like a great deal today, but if it’s putting you at risk of not being able to attract capital from certain parts of the world due to certain ESG risk factors, we take that into consideration,” Wylie said. “We strive to think holistically and with a long-term lens about some of the risks that investments could expose you to, and simultaneously, some of the value creation opportunities an investment could present, as well.”

Embarking on the ESG Journey

Partners of the firm empowered Sophia and Wylie to formalize a program and strategy. That meant equipping them with the right tools — and working with Novata was essential in that process. “Once we were introduced to the Novata customer success managers, we felt that we were in great hands with the team and that they had a handle on understanding the ESG landscape, what we needed to track, why we needed to track it, and how we needed to do it,” Sophia said.

Bonaccord’s goal for collecting ESG information was to measure quantitative data and track that progress year-over-year so the firm could show its GPs, and the broader market, how ESG is trending in the portfolio. “We found that Novata’s platform made it simple for us to get up to speed on how to pick out key trends and metrics. Novata has been instrumental in helping us understand what we need to know,” Sophia reflected. “Wylie and I had just started in our roles at Bonaccord, and as we began thinking about how to structure our program, Novata proved instrumental in helping us understand ESG trends and the market landscape broadly. I don’t think that overstates the importance of Novata with respect to our ESG program and our ability to get up the curve.”

Wylie added, “It’s been fantastic working with the team more broadly and certainly the best that we’ve found for what we need.”

Building Frameworks and Collecting Data

With the right tools in place, the Bonaccord team got to work on specifically what to measure. Sophia noted that the firm’s previous ESG data collection framework was focused heavily on qualitative data and mainly Bonaccord-specific metrics that didn’t enable the team to benchmark data against the broader private markets universe.

With the help of Novata, Bonaccord reorganized the framework to reflect quantitative, comparable data aligned with existing frameworks and regulations such as the EDCI, SFDR, and UNPRI — without overwhelming respondents.

“It took us some time to understand which frameworks are most important, which questions we needed to ask, and how to properly put together a framework that didn’t have 85 questions and multiple sub bullets, which Novata helped us do,” Sophia said. “Novata’s alignment with the frameworks made it simpler because we could get a better understanding of what we needed to ascertain from the sponsors and how to tailor our reports to get sufficient information..”

These efforts paid off — the firm received a 100% response rate to its ESG survey during the first year of data collection on the Novata platform. This response rate signifies the strength of the partnerships that Bonaccord has developed with its GPs and that they understand the importance of tracking these metrics and indicates that the GPs felt the survey was dynamic, flexible, and simple. Bonaccord’s GPs mentioned they appreciated the way the survey was structured and that the questions asked were easy to figure out in-platform.

Tangible Benefits from ESG Data

The ability to collect high-quality ESG data has been essential to Bonaccord’s success and is an ongoing priority, especially as the firm responds to increasing LP requests and expectations. Wylie and Sophia noted they have received more questions from LPs, even over the last two quarters, on ESG topics. These topics include questions about firm growth, diversity and inclusion policies, interest in how the firm is thinking about climate change, and consideration of governance factors that impact human rights.

Additionally, Bonaccord achieved designation as an SFDR Article 8 fund last year, opening the door for opportunities as it continues efforts amongst the European LP base.

Across several facets of Bonaccord’s business, having ESG data at the ready has been crucial. “It’s been critical on the fundraising side to accurately complete data requests and align with investor needs.” Wylie noted this is especially important for working with European LPs, as many investors will not consider funds that are not Article 8 compliant.

From an investment perspective, Wylie noted, it’s been “a significant differentiator to track ESG data and see what’s going on within the firms that we partner with,” Wylie said. “And when we’re thinking about origination efforts, being able to refer to ESG data in conversations we’re having with prospective partner sponsors has also been an invaluable way to lend insight on the market and showcase our value-add.”