In this episode, Jeanne Lee, Head of APAC Sales at Novata and SaaS industry veteran, joins us to discuss the evolving landscape of sustainability in the APAC region. With nearly two decades of experience in the SaaS industry, Jeanne brings extensive expertise as she delves into the urgent need for decarbonization and the growing interest in sustainable investment opportunities.

About Sustainable Intelligence

Sustainable Intelligence is an interview series from Novata that explores ESG and sustainability in the private markets. From carbon accounting to using data to create value, the series dives into the challenges and opportunities facing private market investors and company leaders as their integrate ESG across the business and respond to regulatory requirements. Each episode centers authentic dialogue, highlighting experts at the forefront of advancing ESG data collection and driving meaningful progress in the sustainability landscape. Listen to more episodes.

Conversation with Jeanne Lee (Transcript)

Ella: Welcome to Sustainable Intelligence, where we discuss all things, ESG and sustainability for the private markets. Brought to you by Novata. I’m Ella Williamson and I’m thrilled to be your host.

Today, we’re joined by Jeanne Lee, Head of APAC sales at Novata. Jean has been in the SaaS industry for almost two decades now. Spanning from compliance data to disruptive unicorns, providing employment and education.

Today, we’re going to be talking about what sustainability means across the APAC markets, how to incentivize companies to collect ESG data and is tech really the way forward. So let’s dive in. We know that APAC holds significant importance in the market. Could you share your insights on how the region is shaping up in terms of sustainability?

Jeanne: Well, thanks for having me, Ella. Well, Asia Pacific has a crucial role to play given that it has an increasing share of global emissions. There is an urgent need to decarbonize. PwC actually recently published a net zero economy report in 2021 that showed that the APACs de-carbonization rate was 1.2% where the rest of the wall is at 0.5%. So there is an urgent need to accelerate this de-carbonization rate. And that’s really just one part of ESG factors because. S & G represents social and governance factors. So for those factors, it shouldn’t be new to companies such as, you know, making sure you’re not utilizing child labor or companies that do.

So good practices such as good health and safety for employees, as well as ensuring accuracy in marketing and labeling. These are social governance factors that impact not just the talent that worked for them to create value for the company, but also stakeholders externally like customers and doing right by them. So in my opinion, these are really fundamentals for a well-run business that’s going to be sustainable in the long run. So now when you look at the private markets activity in this space, it definitely has quieten, you know, a fall following the peak in 2018. Fell about 72%. But there’s still activity somewhere. And, you know, PE by out strategies really posted their best fundraising year. Last year. And larger managers also fare well.

So this really means that the largest funds in the world are growing and the investments move to big names who then mean greater exposure to ESG regulations, which is increasingly complex and mandatory. So the region where APAC is placed is really in a good position of financial value creation beyond investment alpha, but also trying to do the right thing, right.

The sustainable way of doing business. I really love the idea of inclusive capitalism. Where our CEO or Alex Friedman has shared a number of interviews. Which really, to me is the idea of ensuring this value for the world we create. We live in.

Ella: Thank you so much. I think that’s fascinating. So although the VC activity may have dipped, private equity strategies are actually thriving. This is definitely suggesting a growing interest in sustainable investment opportunities across the region. So, what I’d love to move on to is how are we going to incentivize companies to monitor and track ESG data?

Jeanne: Yeah, well for private markets, you know, beyond value creation, there’s the incentive.

I would say it’s really a key form of risk management. You know, if companies aren’t doing the right thing by their customers, their employees, or in general, their stakeholders, it makes them a risky investment. So for example, an environmental matrix can review operational efficiencies and resiliency against regulatory changes.

So on the converse is true. Social and governance practices offer insights into company culture, brand reputation and leadership integrity. So these elements are crucial for assessing a company’s long term, viability and stability. So having an effective ESG integration. Allows investors to manage this risk more holistically. Ensuring that their portfolio is not just aligned with sustainability and ethical standards, but it’s also positioned to mitigate risk. That’s going to affect their financial performance. So with this in mind, investors should be really incentivized to champion sustainable practices as part of due diligence as well. Right. And driving positive change while securing their investments against any future uncertainties.

Ella: So it’s really all about effective risk management. Creating value, prioritizing ethical practices and stakeholder wellbeing is paramount for all of these things. And I’d love to know your thoughts on what role does tech really play in helping companies throughout their ESG journey?

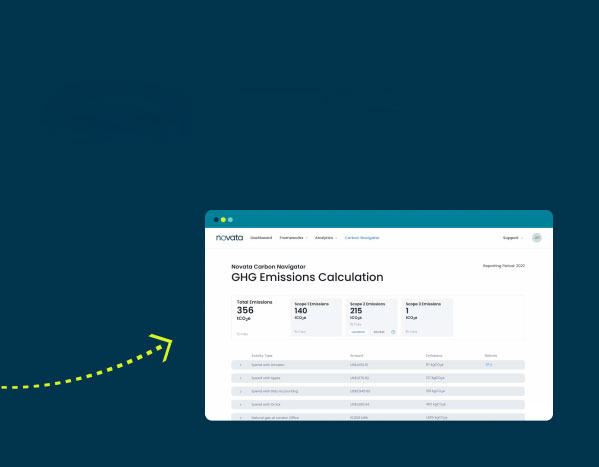

Jeanne: Well, tech is an interesting one. Given my years in tech, that’s always something that we’re making more efficient. So in this aspect, there are many difficulties in identifying what ESG matrix and frameworks companies should be concerned with. So as an example, there’s just hundreds and hundreds, even after thousands of different kinds of matrix, depending on the framework you want to adopt, what kind of regulations you play in? So tech is definitely a great way to condense that and consolidate that and make that more efficient and easier to adopt and document. As an example of a collection of data for carbon emissions. Our clients do not need to go through an expensive exercise of calculating carbon emissions. They can really use technology to very quickly come up with those numbers and be ready for regulatory reporting as well. So we are able to provide investor grade CO2 emissions that makes this process of documentation over time and across multiple companies a lot easier. And also we’ve found, it’s easier to say, get a whole breadth of data and then start looking at benchmarking because then we can see what they really mean. Uh, that makes data a lot more meaningful.

And then that’s where insights can be derived to drive action as well.

Ella: It’s fascinating to observe the diverse approaches to sustainability across different regions in the globe. What role does ESG benchmarking play in the grand scheme of things?

Jeanne: Yeah, I’m, I’m really glad you asked because it is particularly difficult for private markets to have benchmarking information because accessing comparable data is going to be very challenging and probably really hard to access over a lot of skill.

So benchmarking serves a lot more like a compass providing very clear insights to where an investment or portfolio stands relative to their industry peers. And of course, best practices. So this clarity is invaluable because it informs where you’re at in your current positioning and also aids you to guide, you know, portfolio companies to what kind of more meaningful and impactful practices can they adopt?

So with the evolving regulatory landscape that we see in Asia Pacific, benchmarking is going to be very helpful because it’s easy to get lost in what’s important. And then you just end up checking boxes, right. And that’s not what we want, it really cuts through the noise. It helps tell you what’s making a difference and you know, what’s kind of for show. So it’s not about drowning in data or hiring big consulting firms, it’s about the ability to formulate smart focus actions. That’s going to align to where you want to be and ensuring your investments are not only just meeting them, but going beyond that.

So I believe benchmarking really helps with those directions. And like I said, is it like a compass, right? It really keeps all your efforts sharp, meaningful and on track without over-complicating things.

Ella: So the advice from your end is really taking that first step today will be instrumental in adapting to the evolving regulatory landscape and maximizing long term sustainability across APAC.

Thank you so much for your time today, Jeanne. It’s been fantastic having you on. Until next time. Let’s keep building sustainable intelligence together. Find out more at novata.com.