Steve Cain, Senior Manager of Carbon Services at Novata, joins this conversation to explore the topic of financed emissions. Listen as he discusses the history of financed emissions, how they connect to popular reporting frameworks and regulations, and how financed emissions differ from traditional greenhouse gas (GHG) emission tracking.

About Sustainable Intelligence

Sustainable Intelligence is an interview series from Novata that explores ESG and sustainability in the private markets. From carbon accounting to using data to create value, the series dives into the challenges and opportunities facing private market investors and company leaders as their integrate ESG across the business and respond to regulatory requirements. Each episode centers authentic dialogue, highlighting experts at the forefront of advancing ESG data collection and driving meaningful progress in the sustainability landscape. Listen to more episodes.

Conversation with Steve Cain (Transcript)

Mateo Leone: Welcome to Sustainable Intelligence, where we discuss all things ESG and sustainability for the private markets brought to you by Novata.

Today, I’m joined by Steve Cain, Senior mManager of Carbon Services at Novata, who leads the design and delivery of support services related to carbon management and ESG data collection and closely monitors regulatory developments to align with product needs. Thank you for joining us today, Steve.

Steve Cain: Good to be here.

Mateo: Today we’re going to be discussing financed emissions. We’ll be covering some of the basics. We’ll go into some pros and cons. We’ll talk about the landscape. But to start with some context, simply put, what are financed emissions?

Steve: Yeah, I think it might help to take maybe a step back and put finance emissions in the context of greenhouse gas measurement and management. So maybe folks by now have heard of scope one, scope two and scope three emissions. So scope one and two emissions are organizations’ operational footprint and then scope three is really interesting. It’s everything in your value chain and it’s split into two different categories. It’s upstream activities and downstream activities. I mean, it’s like asking the question: what are the emissions that arise from myself purchasing services and products on the market to run my business? What are the emissions that arise from me taking planes to meet my clients?

And there are 15 categories of these emissions, one of which is financed emissions. It is a downstream form of emissions where emissions happen after you’ve deployed your service. And in this case, the service is for financial institutions who deploy capital as a service, right? And finance admissions is sort of like asking, I have via this capital, given an organization or in the form of project finance, this activity the opportunity to exist so I proportionally am responsible for the emissions that arise from that activity.

Mateo: So if I’m a GP already collecting carbon data from my fund, my portfolio companies, what’s the difference for me or what’s the benefit for me in tracking financed emissions?

Steve: Yeah, I think that’s a good question. And then, maybe we’ll talk about the different users, like who might financed admissions specifically apply to? So again, I mentioned financial institutions, but it’s, um, a company and consumer goods are, you know, is this going to be a category of missions for them? Likely not.

I think where you see financed emissions used, you brought up GPs, is that it’s for financial institutions and GPs being an asset manager, they’re a financial institution. This would be a material, a topic of concern for them, because if you look at an asset manager as a business model, it’s actually a pretty simple business model. So their operational footprint, their scopes one and two, maybe they have 15 people in an office, they’re purchasing electricity to power the office on a day-to-day basis. But when it comes to scope three, maybe they’re taking planes to visit their investments to conduct diligence, to engage portfolio companies. They’re obviously purchasing products and services, and then there’s financed emissions, which according to some estimates by CDP can be 700 times that of their operational footprint. So far and away is the most important topic for an asset manager on the greenhouse gas emissions front to be managing and thinking about.

And so why would they want to consider thinking about this? One, the impact that I just mentioned. And two, financed emissions really gives you the ability to understand when you’re investing in a portfolio of diverse assets where carbon intensity is concentrated. It lets you know, dollar per dollar of capital deployed or of revenue who’s outperforming, who’s leading, who has room to improve and it’s just a, it’s a window into how your companies are doing on carbon.

Mateo: So let’s let’s talk to the landscape a little bit because we have tons of different frameworks, ISSB, obviously, CSRD and SFDR in Europe and now we have PCAF’s financed emissions; so there’s a lot of different methods of tracking carbon and a lot of different frameworks that have it. How do those, how do they work together? And or do they not?

Steve: That’s a great question. For the historical context here, you know, the Greenhouse Gas Protocol is the global standard, right? That’s what we look to. And GHG Protocol has guidance related to financed emissions. It’s scope three category 15, emissions from investments. And while that guidance is really good, it doesn’t fully address all the specific nuance that comes from capital market transactions. So, to that end this group of Dutch financial institutions in 2015 said, can we build off of the Greenhouse Gas Protocol? And can we make a set of global guidance that is a little bit more context specific here. And to that end, that’s where PCAF comes into play. It stands for the Partnership for Carbon Accounting Financials. And so PCAF very much works, it’s interoperable with the Greenhouse Gas Protocol, builds upon it and they work quite nicely together.

Where it gets a little bit more complicated in a global context is that, you know, now you’ve got the Greenhouse Gas Protocol and PCAF for financed emissions. PCAF can be used in TCFD, which is the Task Force for Climate-related Financial Disclosure. The TCFD was subsumed by the IFRS ISSB. So there’s this big push for the homogenization of all these frameworks. And so theoretically you can actually take the steps, you know, if I’m disclosing PCAF, I can put that in a TCFD report, which now is interoperable with, you know, the ISSB’s S1 and S2 climate disclosures.

And then the next step that we might take is okay between maybe North America, Europe, and APAC, does this work across these jurisdictions? And that’s where it gets a little unclear because, theoretically, the ISSB, which is a global, voluntary standard that would like to be implemented by all these different jurisdictions, theoretically, it can work with some of these regulations that we see in Europe. But there’s actually a wrench there and that comes in SFDR reporting. So the way that financed emissions are calculated and reported are fundamentally different under the SFDR regulation in Europe than they are from PCAF.

And I think the final thing we’ll say from that is that PCAF is a voluntary standard. The two things that you achieve from doing it are one, getting a sense of where your carbon intensity is within your portfolio. Two PCAF’s methodology has data scoring, which is really important when it comes to carbon. There’s highly variable data everywhere. And when you’re making decisions and trying to analyze carbon data, understanding the quality of that data is paramount. That’s something that you can achieve via PCAF but it remains unclear if PCAF readiness will really equate to the, you know, the same thing as having readiness to report financed emissions to SFDR.

Mateo: Sure, so in some cases, as it is with TCFD and ISSB, there’s potentially good interoperability, but yes, maybe a little bit of ambiguity with some of the other frameworks and regulations and standards that are being produced currently.

Steve: Yeah, that’s exactly right. And I kind of touched upon this before, but here at Novata, we work with general partners in North America, in Europe, and now increasingly in APAC, and the conversations that we have, particularly for those GPs who’ve just started measuring carbon across their portfolio, is so what and what next?

It’s the proverbial question. We get it all the time. Let’s just say in a simple example, I have 10 portfolio companies. I’ve successfully measured emissions, which is a feat and should be applauded. But now you’ve got 10 portfolio companies, each with their own carbon footprint in an absolute metric, tons of carbon dioxide equivalent. And so what we might do is we can do this simple eyeball test, like, look isn’t that interesting company A has more absolute emissions than company B.

And then we still ask the question. So what and what next? Right. Like, what do we do with this information, right? Maybe they’re in the same industry and so we in our minds have a sense that like, it’s a little bit of a benchmark, but not quite right. But at the end of the day, it’s kind of like saying if company X has, you know, a hundred metric tons of absolute emissions and I own 50% of that company, then my financed emissions, the share that I’m responsible for as a general partner, because I deployed that capital is 50 metric tons of carbon.

And where that gets really helpful is that now for my 10 portfolio companies where I’ve measured emissions, I can see on a revenue basis, I get a carbon intensity. So it’s a normalized metric for us to compare apples to apples instead of apples to oranges.

So it just gives us the ability to understand how companies are moving. And the final thing I’ll say is that, our knee-jerk reaction when we see that a company has, you know, higher emissions than another is like, Maybe we should focus on that company. And what finance emissions analysis gives us the ability to do is we can actually look at industries that are by their very nature carbon intensive and we can say actually that company is actually doing quite well. I’ve got two other companies that are in that industry. That’s a best-in-class industry. What are they doing over there? You know, let’s figure that out and let’s share those learnings across the portfolio and let’s create some value and so I think it’s it’s an identification of risk and it is, the very beginnings of understanding how you can turn the simple measurement of, or the requirement of in most cases of reporting carbon data into a value creation exercise.

Mateo: Yeah. That makes sense, I want to elaborate a little bit more on the portfolio companies and what it reveals, but while we are talking about PCAF, we have financed emissions, but PCAF also has facilitated emissions and insurance associated emissions. What are those and how do they differ from financed emissions?

Steve: Yeah. So there’s only a handful of, and PCAF has three different standards that they’ve implemented. And the one that I’m referring to today, actually is for general partners, it covers a handful of asset classes. I mean, the whole reason why PCAF was started in the first place is you can’t have a one size fits all to doing these things. So the math has to necessarily change given the context. You can’t have the same logic going into the issuance of mortgages in car notes as you have to business loans to private companies or business investments in unlisted equities, for example. What PCAF has done is expanded into some of these other areas in the capital markets, which makes sense.

Mateo: Yeah, it does. Thank you for that context. So going back to materially how financed emissions can support GPs, what can it reveal about a GP’s portfolio companies?

Steve: I obviously am very passionate about this work and I find it, you know, intellectually engaging and interesting, but I do think it is fun sometimes when you’re working with a general partner, they know these companies day in, day out. They did diligence, they pick their winners, they’re in the business of picking winners, that’s what they do. And so they know all these things, these intimate details about how these companies run, the management teams and how everything’s going but what they probably don’t know and have never seen is the carbon intensity across their portfolio companies.

And so it can be really interesting and dare I say fun sometimes when you’re working with these folks and you’re like, Hey, check this out , did you know company XYZ is actually doing some interesting things over there, and that goes back to that value creation piece. I think it’s just, fundamentally what we’re doing here is we’re looking for climate risk that you didn’t know about. Probably couldn’t know about during diligence. And can only know about now through ongoing monitoring of carbon data. And then the only thing left to do is for us to ask the question, is carbon impact or carbon performance going to impact and create a risk or is there a story of value here so that when we exit this company at the end of the cycle is there a good story to tell here?

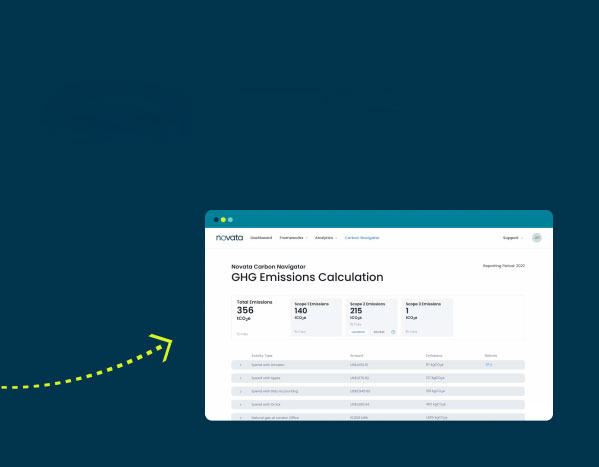

I think that financed emissions gives us that ability to peek under the hood and say, how are the companies in my fund, in my portfolio, performing against each other against the portfolio and then, on the Novata platform against the Novata benchmark, which is like 7,000 companies. It just gives you that, that ability to see things that you likely haven’t seen before. And I think that’s pretty cool.

Mateo: Basically giving a more advanced view of the carbon footprint and a bit of a weighting system to understand exactly what your firm is responsible for.

Steve: Exactly right. I think from a data quality perspective too. I talked about that before, but it will also give you the roadmap of where you need to engage.

Mateo: Sure. So you mentioned a roadmap, let’s talk about the future a little bit. What does the future direction of financed emissions look like?

Steve: You know, I don’t know. I’ll tell you what we’re seeing, which is we’re having more conversations with people who are interested in measuring this.

Let’s start with challenges and future directions. So there are some clear challenges for the way that finance emissions are calculated, and they can be actually pretty glaring, you know, when it depends on the methodology that you use to calculate this stuff. So the way that it’s being handled now is that many of the people in the marketplace are using proxy based estimates of varying degrees of data quality, and that presents a huge problem, right? Because we can’t make decisions off of it. Maybe from an initial hotspot perspective, it points an arrow at what we should be looking at. I think that’s all well and good, but that is a challenge.

I think the second piece is that, the way that we calculate our ownership percentage, that’s been the subject of some debate amongst reporters of financed emissions. You know, is this really capturing our ownership share, changes and fluctuations in ownership throughout the year, through the cycle? And so some of these issues, I think, are going to be addressed.

It’s unclear to me how PCAF readiness gets you set up for success if you’re on the hook for the European SFDR regulation. Those are two different data processes. The way that you collect the data, the types of financials that you need to run these equations are different. For my part, I try to explain this to people all the time is that it’s a readiness exercise. You get fundamentally different things from a PCAF exercise than you do from reporting to SFDR. I think that’s really important.

Long-term, I suspect that you will see an improvement with how we measure these. And I think what you’ll really start to see then is people leveraging financed emissions to really drive carbon performance. I think there are relatively few asset managers on the planet that have signed up to set science-based targets. They number probably less than 30 globally but you might see more asset managers setting science-based targets to reduce their finance emissions. So I think that’s certainly something that we’ll see, but in terms of market uptake and adoption of a voluntary framework, it is voluntary. It just remains to be seen whether this is the tool that everybody wants to use to communicate or whether they want to use it internally to really understand what’s going on.

Mateo: Great, so it sounds like still some work to be done. Do you think that that comes from, you talked about the methodology a little bit, does that come from the financed emissions calculation side or is that fundamentally at a base level of those GHG emissions, how we’re collecting those? Or is it a little bit of both?

Steve: It’s everything. You can’t have meaningful financed emissions unless you have bottoms-up company-provided data, full stop. And that is a real barrier and it is just not achievable too many, most even.

And so I think, you know one of the things that we’re hyper focused on here is that we lean on proxy based top-down methods as a break glass in case of emergency, it’s a method of last resort. And I think that in order to make this decision useful, we really want to support underlying portfolio companies and investments to calculate their emissions footprint.

And then we can roll that information all the way up the chain from a portfolio company to a general partner, to a fund of funds, to a limited partner. So the idea is for us to have this more bottoms up approach, because we know how imperfect that data quality is from the carbon front.

And then in tandem, I think that there’s been an acknowledgement for PCAF that the way that it’s been calculated previously, you know, when we calculate our ownership percentages, is imperfect and so for their part, they’ve signaled that they’ve got this working group dedicated to potentially solve some of these issues. You know, how does changes in EVIC over time or definitions of EVIC or things of those nature really skew or influence? Because the reality is, is that it does result in significantly different numbers of reported financed emissions compared to absolute emissions.

So how you calculate this stuff definitely matters. But as the tool stands today, it’s still gives you directional arrows of progress, it’s still points where your most carbon intensive assets are, it still points to where there are issues of data quality in an opportunity improvement, it still points to best performers that you can go look to share those value creation stories with other assets in your portfolio.

Mateo: Sure. So work to be done, but very good barometer currently.

Steve: Yeah for helping with firms. I think so.

Mateo: I do just have one more question based on that commentary actually. You got big firms, you’ve got small firms, you got VCs, growth, a lot of different investors. Is there a specific group that would benefit more from tracking finance emissions or is it pretty blanketed?

Steve: Yeah. So, fortunately, PCAF has guidance for a variety of asset classes, and so everybody from private credit to venture to private equity has a way to do it. Interestingly, in 2020, PCAF noted that they don’t actually have great answers for private equity and private credit. And we should look for specific guidance for PE and PC and in future updates. So for right now, most people are using guidance for unlisted equities in business loans to private companies. And so that’s what everybody’s using today.

But the short answer to, you know who does this apply to and can it be useful? I think the answer is it can be useful to anybody who’s engaged in these activities. And the next steps are just to figure out which asset class to use based on where the guidance is today.

Mateo: Got it, great context. Thank you.

Well, Steve, thank you for joining us today and sharing your insights on this episode of Sustainable Intelligence. For more insights on ESG and sustainability in the private markets. Please visit novata.com. And until next time, let’s keep building sustainable intelligence together.